Data-Driven Precision for Smarter Underwriting.

Move beyond traditional risk models. rooya.ai provides insurance partners with objective, real-time driver behavior data and irrefutable video evidence, empowering you to reduce claims, combat fraud, and create more accurate policies.

Request a Consultation

A New Era of Insurance Intelligence

Accurate Risk Profiling

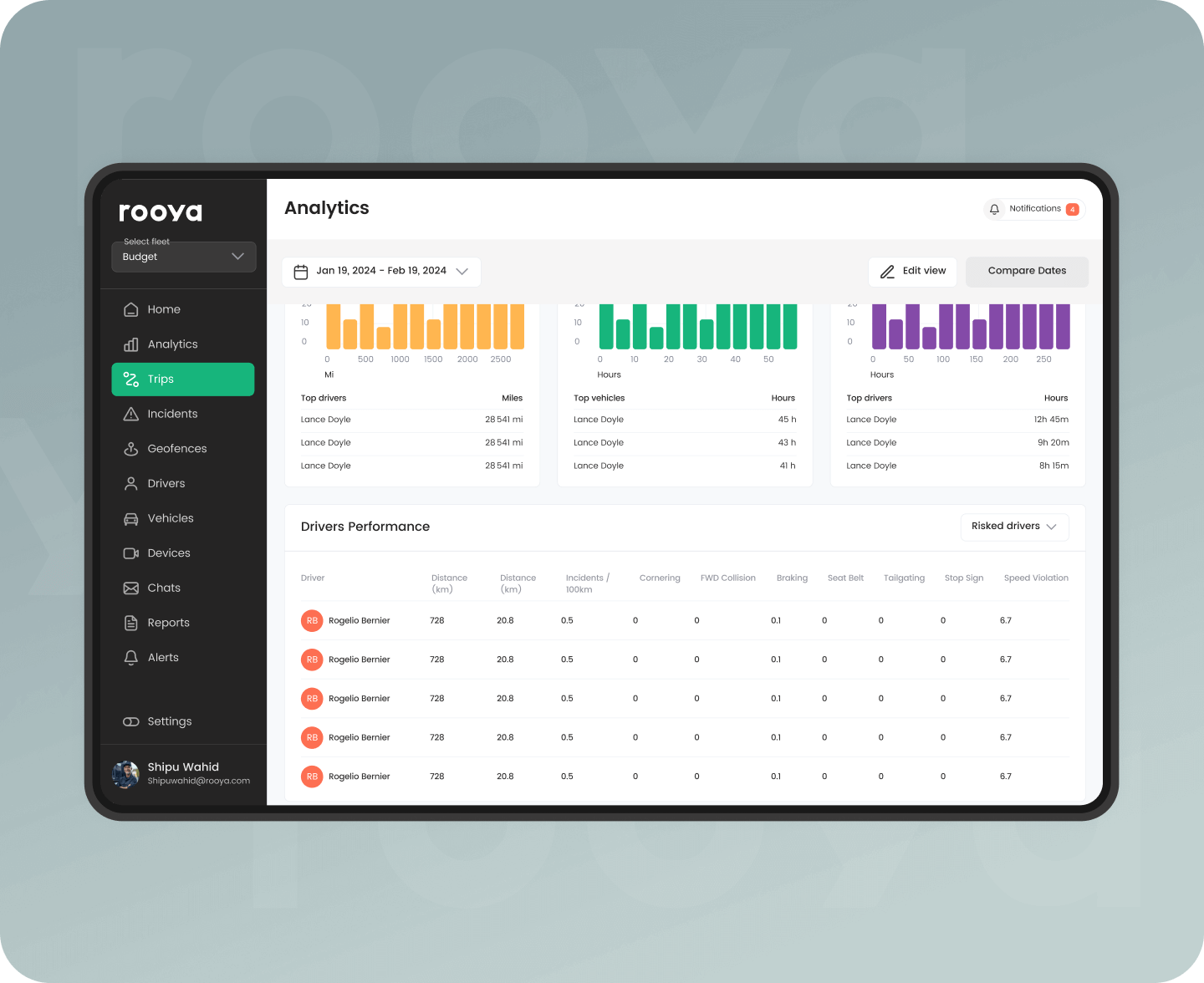

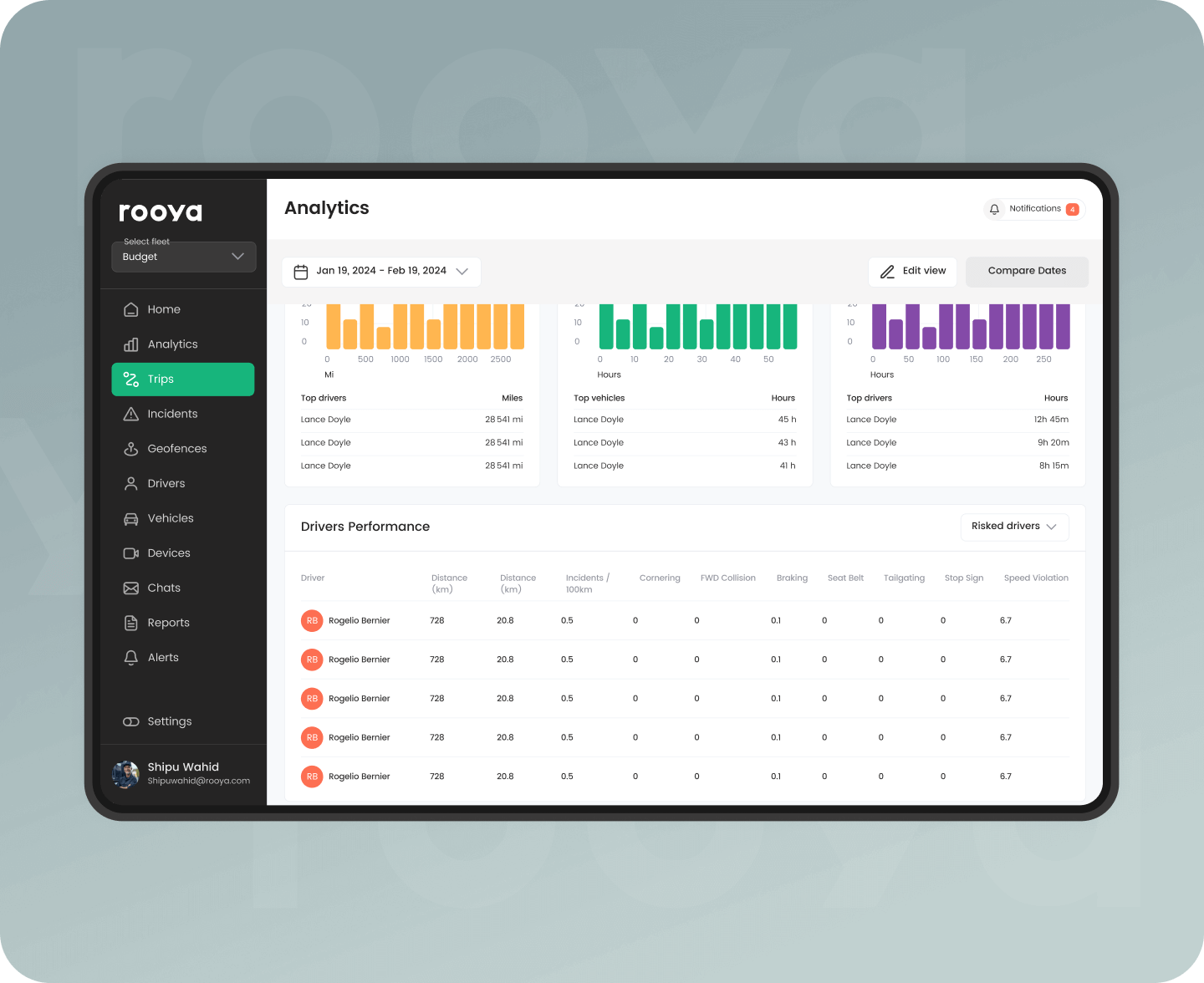

Price policies with confidence. Utilize detailed driver scorecards and behavioral data to assess risk more precisely and make informed underwriting decisions.

Claims Frequency Reduction

Partner with fleets that use our proactive AI safety features. Lower the frequency and severity of claims by preventing accidents before they happen.

Streamlined Claims Processing

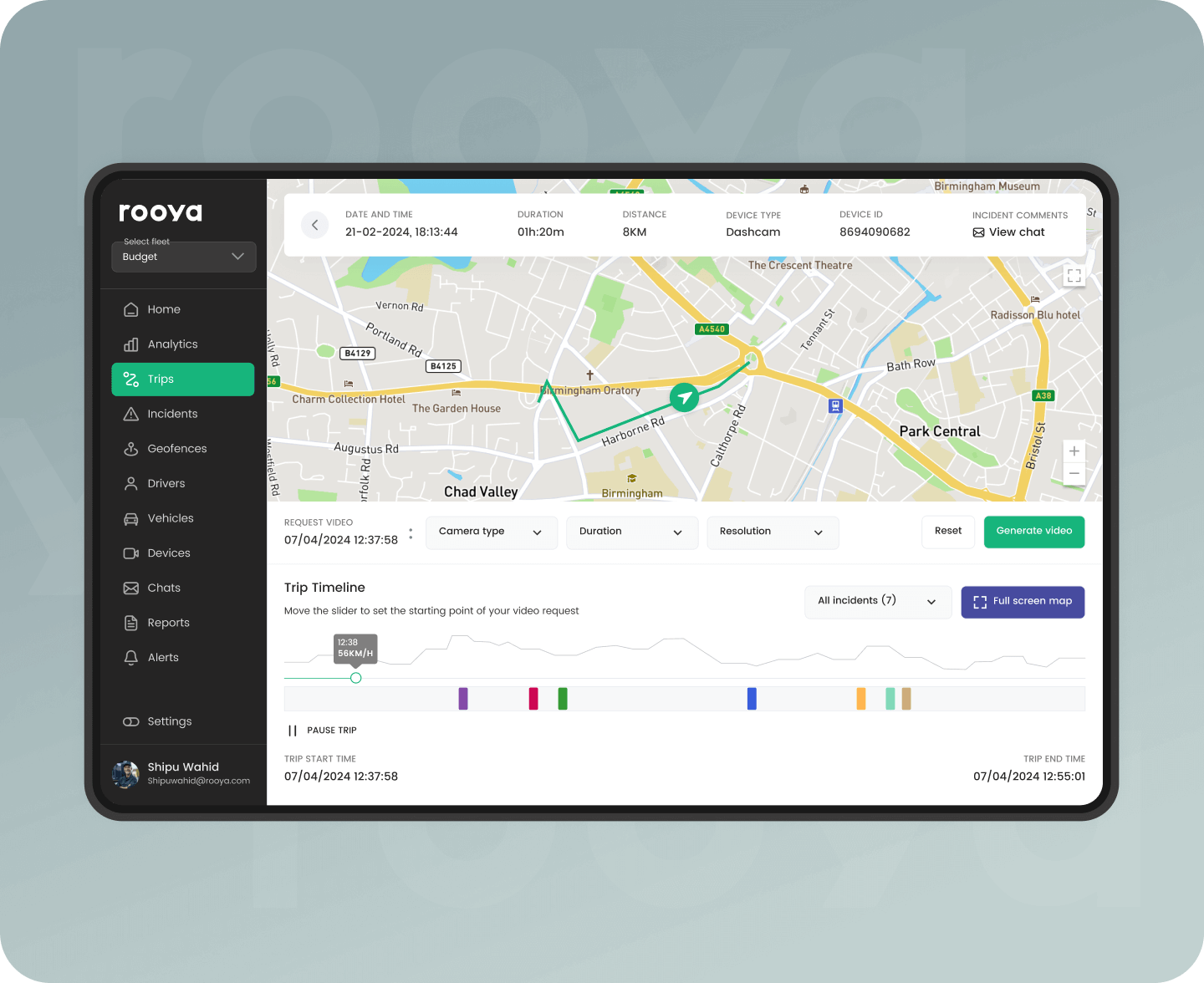

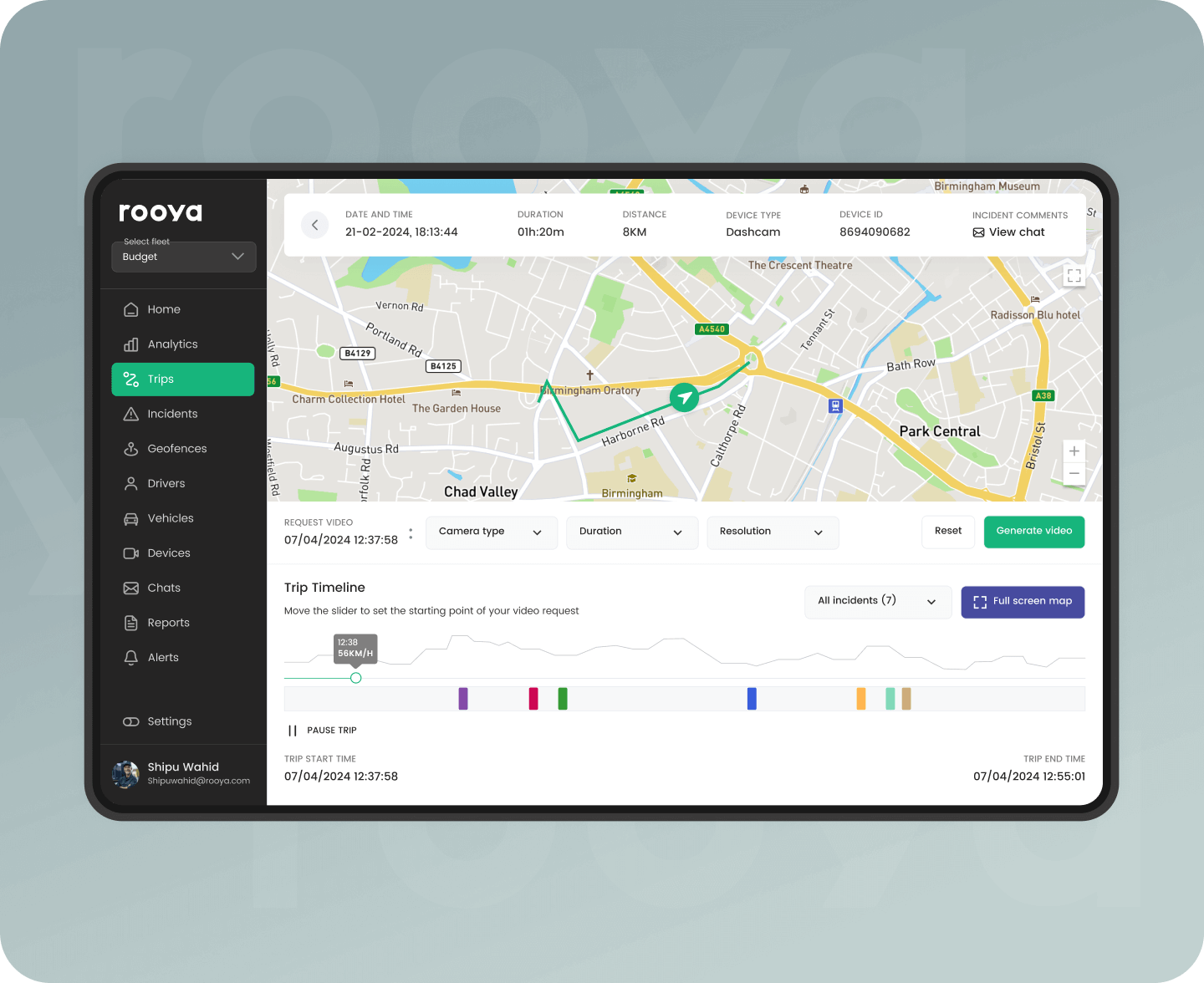

Accelerate your claims lifecycle. Use time-stamped HD video evidence for instant First Notice of Loss (FNOL) and to quickly determine fault, reducing investigation costs.

Combat Fraud with Irrefutable Evidence

Stop relying on subjective accounts. Our platform provides the objective truth of what happened on the road.

Receive immediate, high-definition video of any incident, providing clear context from the very first report.

Correlate video evidence with precise data like speed, G-force, and location to build a complete, factual picture of any event.

Quickly and fairly settle claims with clear, unbiased evidence, minimizing lengthy and expensive legal disputes.

Data-Driven Underwriting Support

Refine your underwriting process with access to comprehensive performance data from your insured fleets.

Go beyond demographics. Use AI-generated scores based on actual on-road behavior to price risk accurately.

Access long-term data to identify safety trends, evaluate the effectiveness of risk management programs, and reward the safest fleets.

Work with us to develop custom reports that feed directly into your existing underwriting models and workflows.

Partner with rooya.ai to Build a Safer Future

We work with our insurance partners to create programs that benefit everyone: insurers, fleets, and drivers.

Incentivize Safety

Develop programs that reward safe driving behavior. By offering premium discounts to fleets that use rooya.ai and demonstrate improved safety scores, you can attract and retain lower-risk clients.

Shared Data Ecosystem

With fleet consent, gain secure access to the data you need for underwriting and claims. Our platform ensures data privacy and provides a seamless, permission-based sharing process.

Contatct us

Ready to Revolutionize Your Risk Management?

Discover how our AI-telematics solutions can empower your underwriting and claims processes with data-driven precision. Let's build a more profitable and predictable future together.